Neighborhood Assistance Program (NAP)

Youth Opportunities Program (YOP)

Pregnancy Resource Center (PRC)

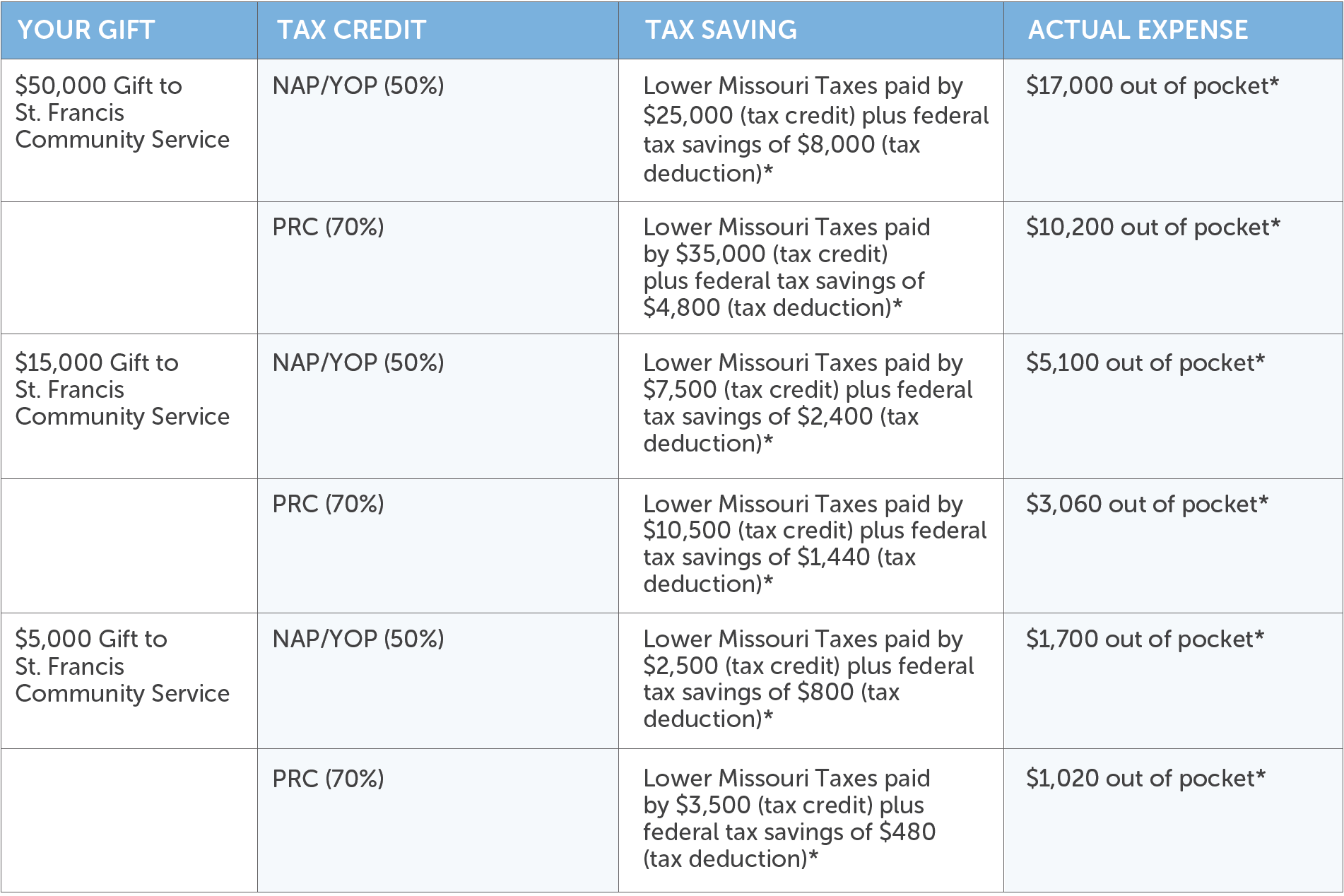

St. Francis Community Services is approved to offer NAP, YOP, and PRC credits for 2022. Eligible donors receive a Missouri tax credit equaling either 50% or 70% of your gift to St. Francis Community Services. This credit combines with your federal and state charitable income tax deduction to lower the actual net cost of your gift to cents on the dollar.

Example Using 32% Tax Bracket

* The above calculations assume a 32% bracket (applies to the following taxable income levels: Single: $160,726 – $204,100; Married Joint: $321,451 – $408,200) and that state tax is NOT deductible when calculating federal tax because new tax laws limit the state tax deduction for most individuals. In addition, the above scenario assumes that the federal tax is NOT deductible for state tax. Finally, the above calculations assume that an individual can, in fact, itemize deductions under the new tax laws. This is not intended to represent tax advice. Please consult your tax advisor to learn how tax credits will benefit you specifically.

The Process

- Make an eligible contribution of $1,000 online or direct mail to St. Francis Community Services before midnight on Dec. 31.

- Be sure to indicate your desire to apply for tax credits on your donation (check or online form memo line). We will send you an acknowledgment and brief instructions on how to fill out the tax credit application.

- Fill out the form and return the form.

- Catholic Charities will validate the application and file it with the State of Missouri.

- The State of Missouri will process your application and send you an Eligibility Certificate to include with your state tax return and form MO-TC.